How will Bitcoin, Ethereum and the digital euro be affected by Q-Day?

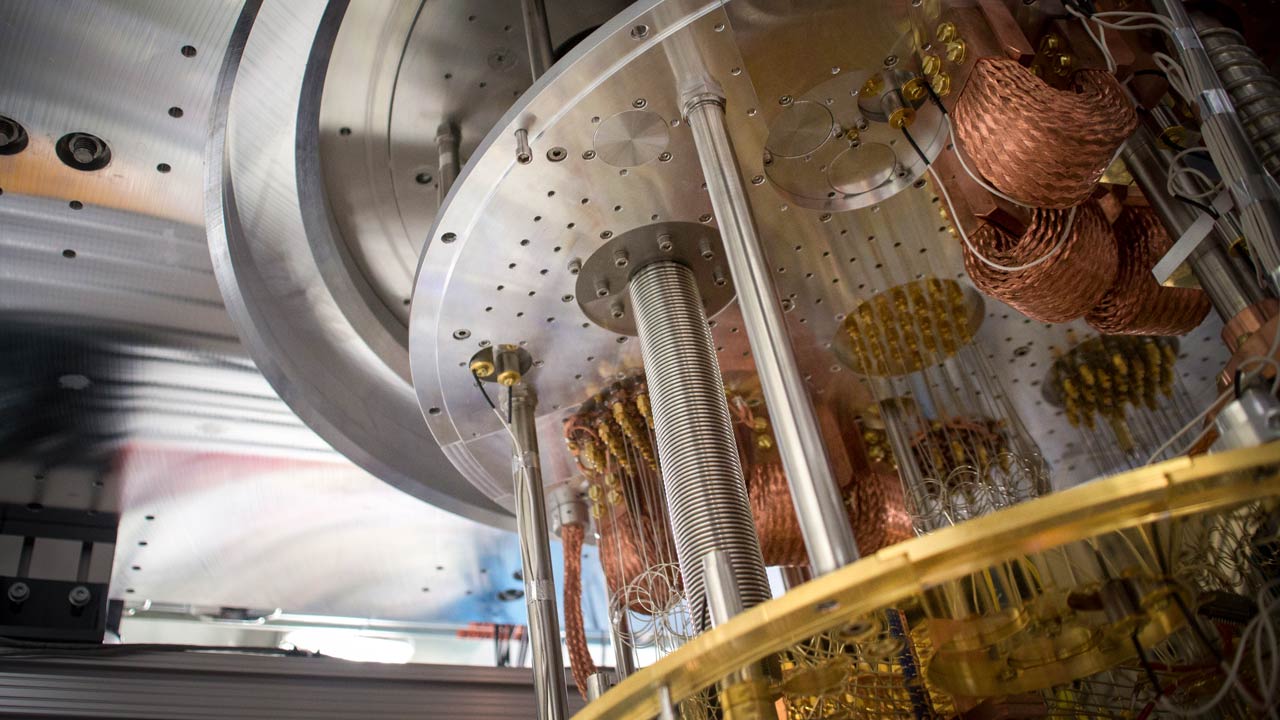

Quantum computing will be capable of solving in seconds mathematical problems that would currently take thousands of years. And it is precisely those mathematical problems that underpin the cryptography protecting the internet, including Blockchain networks: cryptographic algorithms such as RSA or ECC are secure against classical computers, but vulnerable to quantum computing. Hence the need to migrate to post-quantum cryptography (PQC), designed to resist sufficiently advanced quantum computers.

_____

A few weeks ago, we published a technical analysis on the claim that quantum computing could hack Bitcoin in 320 seconds. The conclusion was that it is a myth at the current stage of quantum technology.

However, the underlying question remains valid: what will happen to Bitcoin, Ethereum, or the future digital euro when Q-Day arrives — the day quantum computers become capable of breaking the cryptography that protects our transactions?

■ Q-Day refers to the moment when public key cryptography becomes ineffective against quantum computers, impacting, among other things, authentication, signatures, online confidentiality, and Blockchain networks.

The day all locks become obsolete

The security of Blockchain networks relies on algorithms such as RSA or ECC — cryptographic mechanisms, like mathematical locks, that ensure a digital signature is legitimate or that a transaction cannot be forged.

The issue is that these mechanisms were designed for a classical computing environment. Once quantum computers become cryptographically relevant, they will be able to break them in a matter of hours or minutes using algorithms such as Shor's.

The obvious threat is that a sufficiently advanced quantum computer could derive private keys from public ones and forge digital signatures, authorising transactions without consent and breaking trust in the network.

■ Q-Day will not be a sudden event, but rather a programmed expiration of the cryptographic keys — the locks that currently protect Blockchain networks, stablecoins and digital currencies. Every year without updating the systems is like keeping food in the fridge: it's still there, but eventually it becomes unsafe to consume.

What will happen to current digital assets during the transition?

The big dilemma is what happens with everything that already exists. Bitcoin, Ethereum or any Blockchain network using elliptic curve algorithms store millions of public keys in their blocks. These are like exposed digital fingerprints that, once Q-Day arrives, could allow an attacker to deduce the private key.

This means that current digital assets will need to gradually migrate to post-quantum schemes. This transition will require Blockchain networks to update their protocols to incorporate quantum-resistant signatures such as Dilithium (selected by NIST as the post-quantum digital signature standard). Some networks will be able to do this relatively quickly, while others will face greater technical and governance hurdles.

The process may resemble the transition from IPv4 to IPv6, with years of interoperability between old and new protocols.

During this transition, there will be a hybrid period where two types of assets coexist: the “classic”, more vulnerable ones, and the “quantum-safe” ones. If users' trust shifts towards the latter, the former face the real risk of devaluation if cybercriminals seize funds — potentially triggering a rapid loss in value.

■ Companies that treat post-quantum cryptography as a one-off technical issue of the future will risk market trust, while those that act today can strengthen it by turning quantum security into a strategic asset.

How will this affect transaction speed and cost?

Post-quantum cryptography doesn’t come free. The new algorithms require longer keys and signatures, increasing the amount of data stored in each block — though this is not the main issue for the network. The real impact lies in computation: every time a transaction is validated, the signature must be verified, and this process is more resource-intensive with post-quantum algorithms. That higher validation load can affect the scalability of networks like Bitcoin.

Will users be willing to pay higher transaction fees in exchange for quantum security? If verifying post-quantum signatures slows things down, transactions will pile up in a queue. To get processed sooner, fees come into play: the higher you pay, the faster you go. We could see users and companies with more urgency or financial capacity choosing to pay more to ensure their transactions are validated first.

As a result, we’re likely to see a period of experimentation in which different Blockchain networks compete to find the right balance between post-quantum security, cost and operational efficiency.

What competitive advantages will emerge between Blockchain networks?

This is the least discussed aspect: Q-Day could redefine the landscape of Blockchain networks. Those able to integrate post-quantum cryptography quickly and efficiently will gain a competitive edge — not just technically, but reputationally.

- In public and open networks like Bitcoin and Ethereum, the ability to integrate quantum-resistant signatures will depend on the community's culture: those more open to change will adapt faster, while more conservative ones will face bigger technical and governance barriers.

- Stablecoins backed by major financial consortia may move more quickly if European regulation requires them to be natively quantum-safe, just as the GDPR mandates privacy by design, or as the DORA regulation and NIS2 directive require digital resilience from the outset.

- Enterprise Blockchain networks, private or consortium-based, (such as those used for asset or identity tokenisation) will be more flexible when it comes to upgrading, becoming real-world quantum transition labs.

The result will be a trust gap between modernised, quantum-protected networks and those sticking with classical schemes. Users will increasingly see upgradability as a key trust and security factor.

■ The strategy is not to wait for the new standard to arrive, but to build cryptoagile infrastructures that allow algorithm changes without disrupting operations. The differentiator won’t be the algorithm, but cryptoagility.

A new metric of “quantum resilience and resistance” could become a decisive factor in assessing digital assets.

Beyond the technical: ecosystem-wide implications

The impact of Q-Day isn’t just about mathematical calculations — it brings consequences for different stakeholders:

- Users: their digital wealth will depend on whether their wallets migrate in time. Holding cryptoassets in addresses with exposed public keys will be risky.

- Financial institutions: custody of digital assets will become a battleground, where offering quantum-resistant guarantees will matter as much as profitability.

- Regulators: will need to set migration deadlines and require all new digital assets to be quantum-safe by design. Europe, through regulations like DORA and NIS2, is already pointing in that direction.

- Tech companies: those providing cryptoagile infrastructures and quantum-safe services will position themselves as strategic partners in this transition.

■ At Telefónica Tech, we are working on Quantum-Safe Networks and Quantum-Safe Services, designed to strengthen networks, infrastructures and communication services against quantum threats.

This means applying cryptoagility strategies and post-quantum algorithms to projects involving tokenisation, communications, digital money and Blockchain services — to build trust among both businesses and users.

If you're saving your money in crypto today — how can you be sure it will still be yours in 15 years?

The post-quantum transition as a strategy

Q-Day won’t mean the end of Bitcoin, Ethereum or the digital euro — because, as with all technology, they will eventually be updated. What it will mark is the start of a new era, where security becomes the very condition for the existence of digital assets. In that future, profitability will be as important as the certainty that keys and transactions are protected from quantum computers.

The real Q-Day isn’t the day a quantum computer arrives, but the day your company realises it’s too late to adapt.

In fact, the post-quantum transition could completely reshape the digital asset landscape. Blockchain networks that dominate today’s market could lose relevance if they fail to adapt in time, while new networks — born quantum-safe — could gain traction. The competition will no longer be only about scalability or energy efficiency, but about offering guarantees of quantum invulnerability.

Conclusion

The myth that Bitcoin “could be hacked in 320 seconds” served as a mirror. Not because it was true, but because it showed how easy it is to imagine a sudden attack and forget the most important thing: the silent erosion of trust in systems that don’t update in time.

Therefore, the real risk won’t come on a specific day, but after decades of inaction. The companies that understand the transition to post-quantum cryptography as a business strategy — not a future technical issue — will be the ones that survive and lead the next era of the digital economy.

■ At Telefónica Tech, we propose a strategic approach based on cryptoagility to adapt systems to emerging threats without compromising current operations.

■ At Telefónica Tech, we propose a strategic approach based on cryptoagility to adapt systems to emerging threats without compromising current operations.

Get our handbook on protecting data from the quantum threat

We invite you to download our Strategic Preparation for Post-Quantum Cryptography guide and start your transition as early as possible towards a cryptographic infrastructure that is resilient and ready for the quantum era.

Hybrid Cloud

Hybrid Cloud Cyber Security & NaaS

Cyber Security & NaaS AI & Data

AI & Data IoT & Connectivity

IoT & Connectivity Business Applications

Business Applications Intelligent Workplace

Intelligent Workplace Consulting & Professional Services

Consulting & Professional Services Small Medium Enterprise

Small Medium Enterprise Health and Social Care

Health and Social Care Industry

Industry Retail

Retail Tourism and Leisure

Tourism and Leisure Transport & Logistics

Transport & Logistics Energy & Utilities

Energy & Utilities Banking and Finance

Banking and Finance Smart Cities

Smart Cities Public Sector

Public Sector